Understanding Deflation: A Look at 5 Notable Global Cases

Deflation, the opposite of inflation, is a decrease in the general price level of goods and services. It may sound appealing, but it can trigger economic challenges. This post explores five notable instances of deflation around the world. We will examine the causes, effects, and strategies to navigate such periods.

The Great Depression (1929-1939)

The Great Depression was a severe global economic downturn. It significantly impacted global GDP, causing widespread hardship. Between 1929 and 1932, the world GDP fell by an estimated 15%. This period is considered the most famous case of deflation.

The causes of deflation during this time are debated among economists. Keynesians attribute it to a lack of aggregate demand. Monetarists point to a fall in the money supply. Austrian economists blame the Federal Reserve's easy credit policies. Personal income, tax revenue, profits, and prices all plunged. International trade fell by more than 50%. Unemployment in the U.S. soared to 25%, and even higher in some countries.

Japan's Lost Decade (1990s-2000s)

Japan experienced a prolonged period of deflation following the collapse of its real estate and stock market bubble. This led to sluggish economic growth and multiple recessions. The bursting of the bubble in the early 1990s triggered a period known as the "Lost Decade."

Deflation caused consumers to delay purchases. This further weakened the economy. The government tried to combat it through monetary policy. However, the impact of an aging population and falling asset prices added to the struggle. Japan's annual real GDP growth averaged only 1.2% between 1995 and 2002.

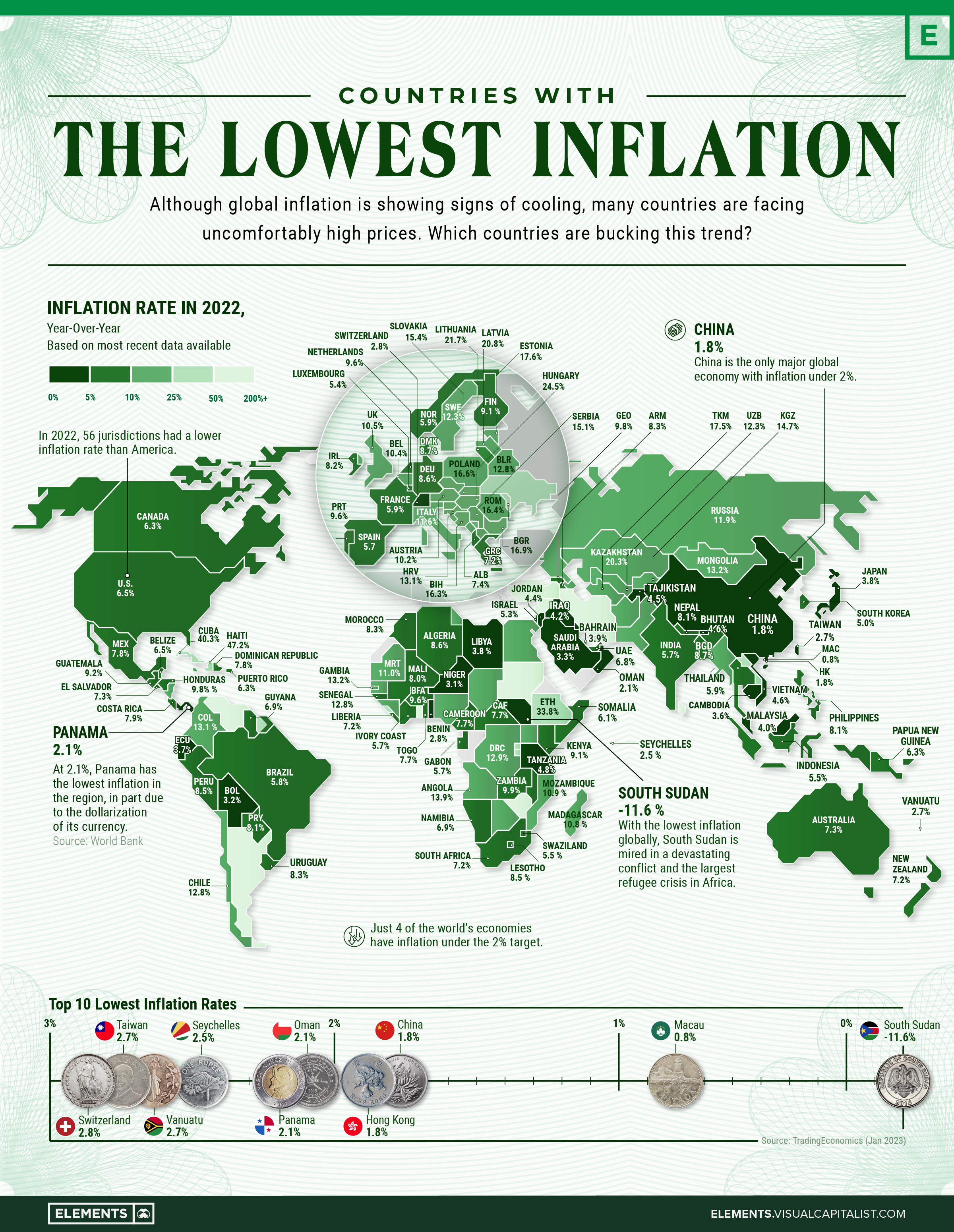

China's Recent Deflationary Pressures (2023-2024)

China has recently faced deflationary pressures. Successive declines in the Consumer Price Index (CPI) have raised concerns. Falling food prices, particularly pork, played a significant role. Additionally, a property market crisis and debt defaults of major real estate companies have contributed.

The CPI in China began to fall in January 2023 and continued through July 2023. It dropped from 104 points in January to 102.7 points in July. The producer price index (PPI) has also been in contraction for over a year. These trends highlight the complex economic challenges China is currently facing. You can read more about the Chinese property market crisis.

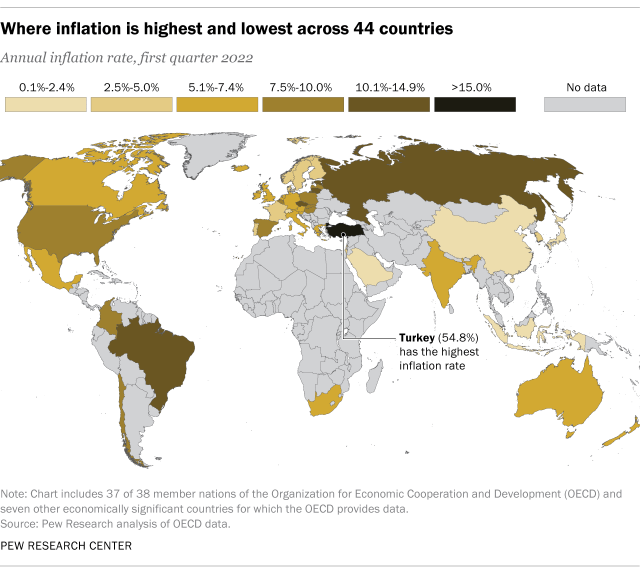

Deflation in Europe (2010s)

Several European countries experienced deflation in the 2010s. Greece, Bulgaria, Cyprus, Spain, and Slovakia had negative inflation rates. This was part of broader disinflationary trends in the European Union and Eurozone. Currency pegs and monetary unions contributed to these deflationary pressures.

The Harmonised Index of Consumer Prices shows the annual average rate of change in these countries. These periods of deflation affected consumer spending and economic stability. It also highlights how monetary policies and currency arrangements can influence price levels.

The United States (Historical Perspective)

The United States has experienced four significant periods of deflation. These include the depressions of 1818–1821 and 1837-1843. The post-Civil War era and the Great Depression also saw periods of deflation. Credit contraction and bank failures played a crucial role.

The Great Depression saw a dramatic contraction of credit and a 30% reduction in the money supply. The recent financial crisis of 2007-2008 also led to a brief period of deflation. Understanding the relationship between productivity and deflation is also important. The US Consumer Price Index shows that deflation has been rare in the US since the creation of the Federal Reserve.

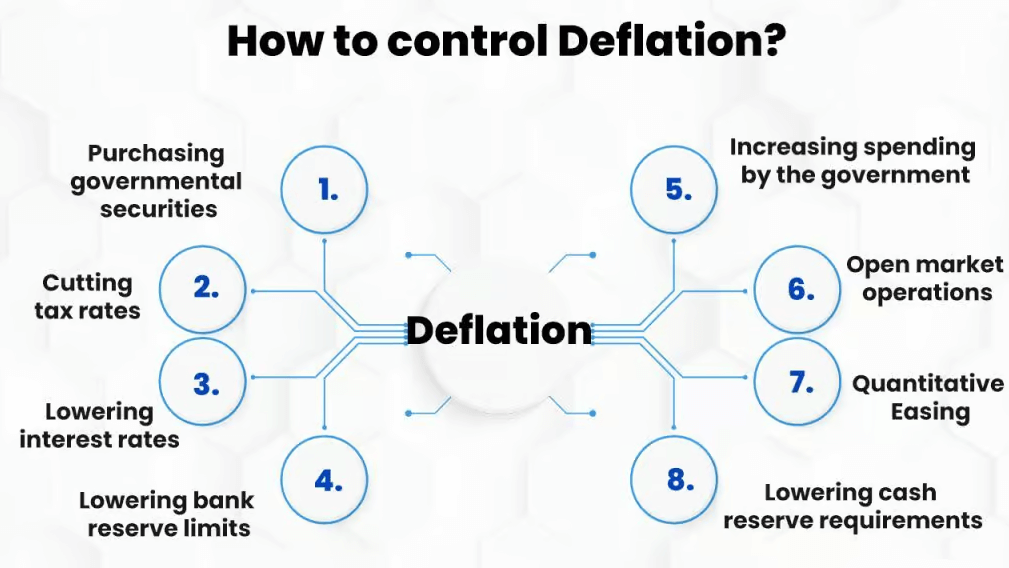

Causes of Deflation

Deflation can stem from various factors. A decrease in the money supply and tight monetary policies can cause deflation. A decline in consumer demand and the hoarding of cash also contributes. Increased business productivity and technological advancements can lead to lower prices. Debt and credit cycles also play a significant role. You can read more about what causes deflation.

Effects of Deflation

Deflation can have significant economic effects. It can reduce consumer spending as people delay purchases. This is because they expect prices to fall further. Deflation can also lead to falling incomes, higher unemployment, and reduced business profits. It increases the real cost of debt and can trigger a deflationary spiral. This can lead to economic stagnation.

How to Prepare for Deflation

Preparing for deflation requires proactive financial strategies. Paying off debt and increasing savings are crucial. Maintaining an emergency fund and cash reserves is also important. Thoughtful spending and resisting the lure of falling prices can help. Diversifying income sources and considering bonds can provide stability. Being cautious about real estate and stock investments is also advisable. These strategies are discussed in detail in how to prepare for deflation.

Deflation vs. Inflation

Deflation and inflation have opposite effects on wealth transfer. Deflation benefits savers and lenders while hurting borrowers. Inflation, on the other hand, benefits borrowers and hurts lenders. Deflation can lead to underinvestment while inflation can lead to overinvestment. It's also important to understand the difference between deflation and disinflation. Disinflation is a slowdown in the rate of inflation, while deflation is a decrease in the general price level.

Conclusion

Deflation is a complex economic phenomenon with significant implications. Understanding its causes and effects is essential for navigating economic challenges. The historical cases of deflation provide valuable lessons. They highlight the importance of sound financial planning and proactive measures. By preparing for deflation, individuals and businesses can better withstand economic downturns.

Key Takeaways:

- Deflation is a decrease in the general price level, opposite to inflation.

- The Great Depression and Japan's Lost Decade are prime examples of severe deflation.

- Deflation can be caused by various factors, including a decrease in the money supply and reduced consumer demand.

- Deflation can lead to reduced spending, increased unemployment, and a deflationary spiral.

- Preparing for deflation involves paying off debt, increasing savings, and diversifying income.

This post has explored five notable instances of deflation. It's crucial to learn from these historical events. This can help us understand and navigate potential future deflationary environments.