Key Takeaways:

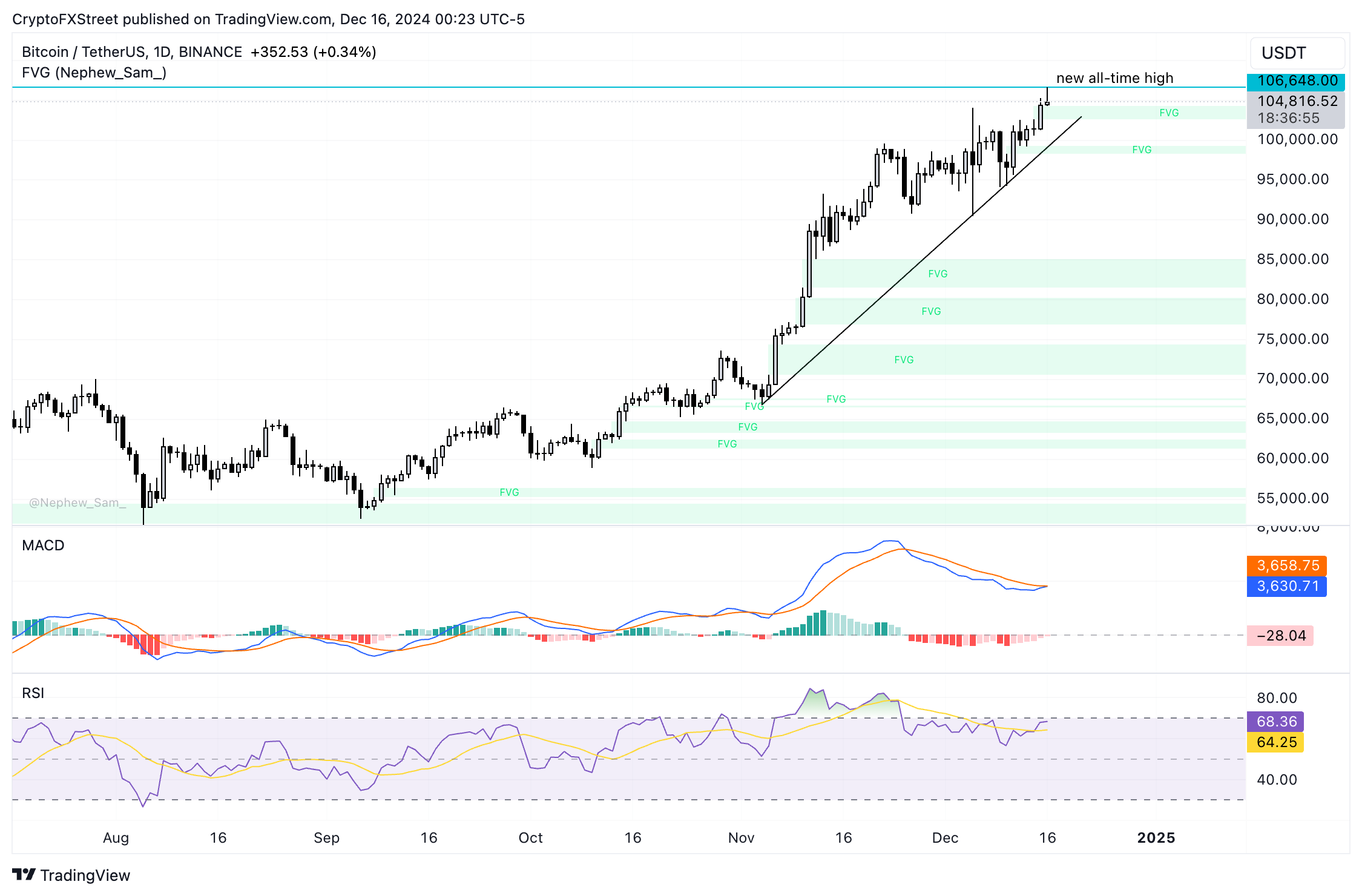

- Bitcoin reached a new all-time high of $106,648.

- Market sentiment is optimistic ahead of the Federal Reserve's interest rate decision.

- Technical indicators suggest potential bearish divergence, indicating a possible pullback.

- Institutional demand remains strong, with significant inflows into Bitcoin Spot ETFs.

- Price predictions range from a bullish target of $119,000 to a bearish support of $90,000.

Bitcoin has once again made headlines by reaching an unprecedented high of $106,648 on December 16, 2024. This surge comes amid heightened optimism fueled by potential policy changes from U.S. President-elect Donald Trump, who has expressed intentions to establish a strategic Bitcoin reserve, which has further ignited interest in the cryptocurrency market.

Despite this impressive rally, Bitcoin has since retreated slightly, trading around $104,600 later in the day. The anticipated Federal Reserve meeting on interest rates this week is contributing to market volatility. Currently, there is an overwhelming expectation of a rate cut, which historically benefits risk assets like Bitcoin. However, the market is also eyeing longer-term projections that could indicate fewer rate cuts in 2025, potentially dampening enthusiasm.

Recent data reveals strong institutional interest, with Bitcoin Spot ETFs experiencing inflows of $2.17 billion last week, reflecting robust demand. Yet, caution is warranted as technical indicators, notably the Relative Strength Index (RSI), suggest a weakening bullish momentum. Observers have noted early signs of bearish divergence, indicating that a correction could be on the horizon.

Analysts are divided on Bitcoin's next moves. Some foresee a potential rally toward $119,510, while others warn of a downside risk that could see prices retesting the $90,000 support level if bearish trends continue. The market remains in what some refer to as "blue-sky territory," indicating that Bitcoin could continue to break its own records if bullish sentiment prevails.

As Bitcoin navigates these critical thresholds, both traders and investors will need to keep a close watch on upcoming economic indicators and regulatory shifts. Given the rapid changes in sentiment and market dynamics, the coming weeks could prove pivotal for Bitcoin's trajectory in the cryptocurrency landscape.

For further insights on Bitcoin's performance and strategies for navigating this volatile market, check out related posts on Bitcoin's record high and the implications of breaking the $100K barrier in this article.