Is OpenAI's ChatGPT Actually Profitable?

Financial writer covering the latest trends in global economics and cryptocurrency.

Financial writer covering the latest trends in global economics and cryptocurrency.

— in Personal Finance

— in Tech Industry Insights

— in Tech Innovation Funding

— in Investing

— in Investing

The buzz around ChatGPT has been phenomenal, but is it actually making money? OpenAI's chatbot has captured the world's attention, but its financial health is a complex picture of rapid growth and high costs. Let's explore the profitability of ChatGPT and the financial strategies of OpenAI.

OpenAI employs a multi-faceted approach to generate revenue from ChatGPT and its other AI models. This includes subscription services, API access, and other channels. Understanding these revenue streams is key to grasping its financial standing.

A significant part of OpenAI's revenue comes from its premium subscription service, ChatGPT Plus. This paid tier offers users priority access, faster response times, and new features. For a monthly fee of $20, users get enhanced capabilities of the ChatGPT-4 model, which is more advanced than the free version.

Another crucial revenue stream is providing API access to businesses and developers. This allows them to integrate OpenAI's models like GPT-3 and GPT-4 into their own applications. The pricing for these APIs varies based on the model used and the amount of data processed. This model has proven to be a valuable source of income for OpenAI.

Beyond ChatGPT, OpenAI also generates revenue from other AI models like DALL-E (image generation) and Whisper (speech recognition). These tools are available through APIs, further diversifying OpenAI's income sources. This strategy leverages its various AI innovations to maximize financial opportunities.

OpenAI's financial journey is marked by impressive revenue growth, but also significant operational costs. Understanding these aspects is crucial for assessing its profitability.

OpenAI has experienced explosive revenue growth, particularly in 2023 and 2024. Monthly revenue reached $300 million in August 2024, a staggering 1700% increase since the beginning of 2023. The company projects annual sales of $3.7 billion this year and $11.6 billion next year. This growth highlights the strong demand for its AI technology.

Despite the revenue surge, OpenAI faces high operating costs. These expenses are driven by the need for significant computing power to train and operate AI models, as well as employee salaries and infrastructure costs. Some estimate that running ChatGPT costs around $3 million per month. These costs are a major factor in its current financial situation.

The high operating costs make achieving profitability a significant challenge for OpenAI. While revenue is rapidly increasing, the company is expected to lose roughly $5 billion this year. This indicates that OpenAI is still in a phase of heavy investment and growth, rather than immediate profit generation.

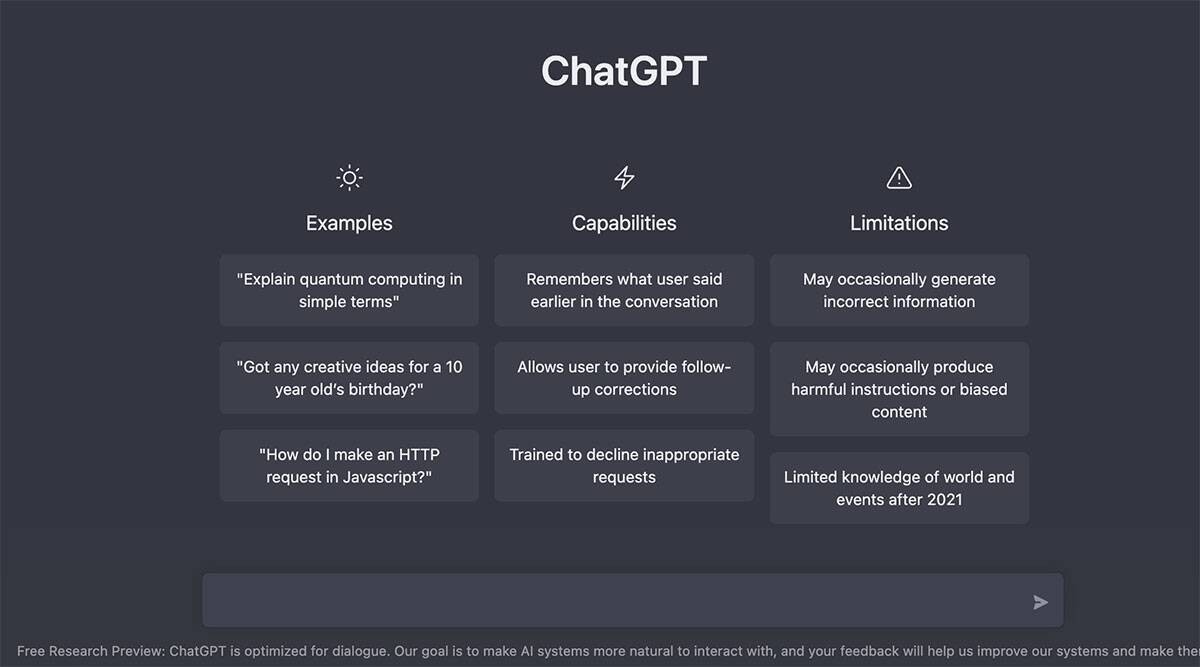

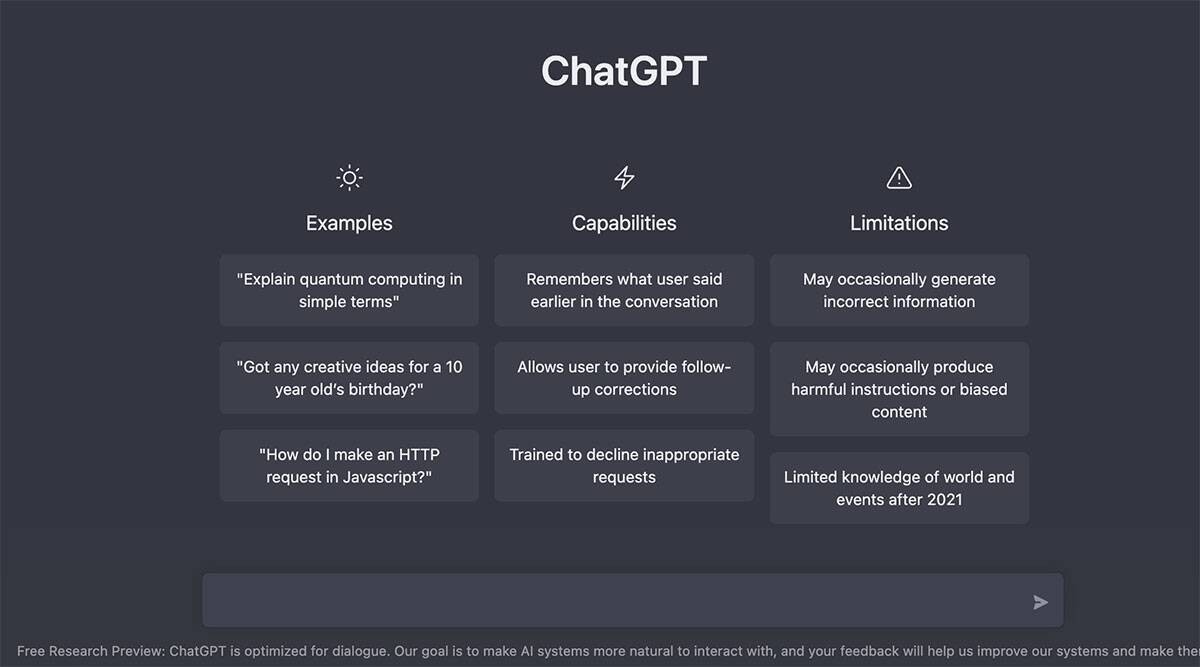

To better understand how ChatGPT operates, let's break down its business model components. This involves identifying its key customers, unique offerings, and distribution strategies.

ChatGPT's customer base is diverse, ranging from individual users to large corporations. These include businesses that use it for customer service, developers who integrate it into applications, and content creators. The broad appeal of ChatGPT contributes to its market reach.

ChatGPT's unique value lies in its ability to generate human-like text, understand context, and engage in conversational dialogue. This makes it useful for a wide range of applications, from answering questions to creating content. These capabilities set it apart from many other AI tools.

ChatGPT reaches users through its website, where individuals can subscribe or use the free version. Additionally, it provides API access for developers and businesses. Strategic partnerships also extend its reach and integrate it into other platforms.

OpenAI faces several financial hurdles, including the high cost of AI model training, reliance on external funding, and increasing competition. These factors will shape its future financial performance.

Training and running large language models like GPT-4 require immense computational power and resources, leading to high costs. The cost of running ChatGPT is estimated to be around $700,000 per day, which impacts the overall profitability. These expenses pose a significant challenge for OpenAI.

OpenAI's growth is heavily dependent on external funding. The company has sought billions in investments to fuel its operations and expansion. This reliance on investors highlights the capital-intensive nature of AI development. OpenAI is seeking a $7 billion investment at a valuation of $150 billion.

The AI market is becoming increasingly competitive, with companies like Google, Meta, and Anthropic developing their own AI models. This competition could put pressure on OpenAI's market share and profitability. This intense competition adds another layer of complexity to OpenAI's financial future.

Despite challenges, ChatGPT and OpenAI have significant growth potential. The company's long-term financial viability will depend on its ability to innovate and adapt.

The potential for ChatGPT and OpenAI is vast. As AI technology advances, new applications and use cases will emerge. This creates opportunities for further growth and expansion into new markets.

OpenAI's long-term financial viability hinges on its ability to reduce costs, increase revenue, and maintain a competitive edge. The company is exploring various strategies to achieve sustainable profitability. OpenAI's unusual corporate structure is also designed to ensure long term financial stability.

The rapid development of AI also raises ethical and societal concerns. OpenAI must address these issues to ensure the responsible and beneficial use of its technology. This is critical for long-term trust and acceptance.

ChatGPT is not just a consumer tool; it's also finding applications in financial analysis. It can assist with tasks like forecasting, budgeting, and risk assessment.

ChatGPT can analyze historical data and market trends to provide valuable insights for forecasting revenue and demand. This helps businesses make informed decisions regarding procurement, labor, and production. It is a powerful tool for strategic financial planning.

ChatGPT can dissect cost structures, highlight key cost drivers, and identify areas for potential cost reduction. This makes it a useful tool for optimizing margins and improving overall profitability. It also helps in calculating production costs for various scenarios.

ChatGPT can analyze various factors to assess potential risks, including supply chain disruptions and market volatility. This allows businesses to develop proactive and contingency plans, mitigating potential financial impacts. This provides a comprehensive overview of a company's financial health.

The AI market is crowded with major players, each with its own strengths and strategies. Understanding this competitive landscape is essential for assessing OpenAI's position.

Google is a major competitor with its Gemini AI model, which aims to compete directly with GPT-4 and ChatGPT. Google's vast resources and access to data give it a significant advantage. Google's developments in AI are a major challenge for OpenAI.

Meta's LLaMA model offers an open-source alternative to proprietary models like GPT-4. This approach can disrupt the market by making AI technology more accessible. This could impact OpenAI's competitive standing.

Anthropic's Claude chatbot focuses on B2B use cases, offering a more conversational and reliable option for enterprises. This strategy targets specific market segments, potentially challenging OpenAI's dominance in the business sector. Anthropic's Claude is a strong contender in the AI space.

ChatGPT has had a profound impact on the AI market, driving innovation and reshaping the way businesses and individuals interact with AI.

ChatGPT has disrupted the AI market by demonstrating the capabilities of large language models. This has spurred innovation and accelerated the development of new AI tools and applications. It has forced other tech giants to invest more in AI.

The success of ChatGPT is paving the way for the development of more advanced and user-friendly AI-powered tools. These tools will likely become an integral part of daily life and business operations. This evolution is set to transform multiple industries.

AI is increasingly playing a crucial role in business operations. From automating tasks to providing insights, AI is transforming how companies operate and compete. This shift is expected to continue and expand in the future.

Key Takeaways: