Understanding the "Pay Yourself First" Concept

What Does "Pay Yourself First" Really Mean?

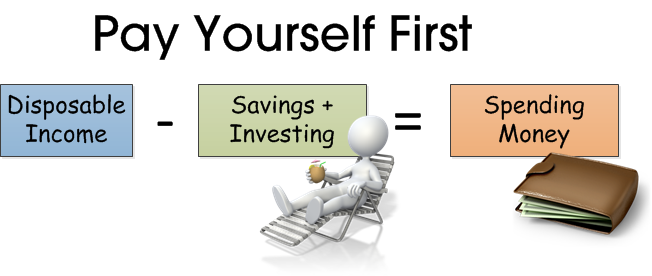

The phrase "pay yourself first" might sound a bit selfish, but it's actually a powerful personal finance strategy. It's not about splurging on luxuries; instead, it means prioritizing your savings and investments by setting aside a predetermined amount of money from each paycheck before you pay any other bills or make discretionary purchases. Think of it as making a non-negotiable payment to your future self. This approach, often called reverse budgeting, ensures that saving becomes a habit rather than an afterthought. As Investopedia explains, it's about automatically routing a specified savings contribution from each paycheck at the time it is received, making it a core tenet of sound financial planning.

Why is Paying Yourself First Important?

The importance of paying yourself first lies in its ability to build financial security and discipline. It's easy to fall into the trap of spending all your income and saving whatever is left, which often amounts to very little. By prioritizing savings, you ensure that you consistently build a financial cushion. This cushion can serve multiple purposes: funding long-term goals like retirement or a down payment on a house, creating an emergency fund to handle unexpected expenses, and ultimately, reducing financial stress and anxiety. According to NerdWallet, this method prioritizes savings, but not at the expense of essential expenses. Additionally, the practice promotes frugality as you become more intentional about your spending habits, knowing that a portion of your income is already earmarked for your future.

Implementing a "Pay Yourself First" Budget

Step-by-Step Guide to Setting Up Your "Pay Yourself First" Plan

Implementing a "pay yourself first" strategy doesn't have to be complicated. Here's a step-by-step guide:

- Assess Your Current Spending Habits: Before you can start saving effectively, you need to understand where your money is currently going. Review your bank and credit card statements for the past few months to identify your spending patterns. This will give you a clear picture of your fixed and variable expenses.

- Determine How Much to Save: A common guideline is the 50/30/20 rule, which allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. However, you can adjust these percentages based on your specific financial goals and circumstances. Remember, it's better to start with a smaller, manageable amount and gradually increase it over time.

- Identify Your Short-Term and Long-Term Savings Goals: What are you saving for? Do you need an emergency fund? Are you saving for a down payment on a house? Maybe you have a retirement plan. Having clear goals helps you stay motivated and focused.

- Set Up Automatic Transfers for Savings: This is where the "pay yourself first" strategy truly shines. Set up automatic transfers from your checking account to your savings account or investment account on the day you get paid. This ensures that your savings are prioritized and you're not tempted to spend that money.

Assessing Your Current Spending Habits

Understanding your current spending habits is a crucial first step in implementing a "pay yourself first" plan. It's about taking an honest look at where your money is going. Start by categorizing your expenses: fixed expenses (like rent, mortgage, and utilities) and variable expenses (like groceries, entertainment, and dining out). Use budgeting apps, spreadsheets, or good old-fashioned pen and paper to track your spending for a month or two. This exercise will highlight areas where you might be overspending and where you can cut back to free up more money for savings. This process is similar to the steps described in our post on finance basics explained simply, where we emphasize the importance of understanding cash flow.

Determining How Much to Save: The 50/30/20 Rule

The 50/30/20 rule is a simple yet effective guideline for managing your finances. It suggests allocating 50% of your income to needs (essential expenses), 30% to wants (non-essential spending), and 20% to savings and debt repayment. This rule is flexible and can be adjusted to fit your individual circumstances. For instance, if you have high-interest debt, you might allocate a larger portion of your income to debt repayment. Our post on understanding the 50/30/20 budget rule dives deeper into this concept and provides a practical guide on how to apply it to your budget. Remember, the goal is to strike a balance between enjoying your present life and securing your future.

Identifying Your Short-Term and Long-Term Savings Goals

Setting clear savings goals is essential for staying motivated and on track. Short-term goals might include building an emergency fund, saving for a vacation, or a down payment on a car. Long-term goals usually include retirement planning, saving for a house, or paying for your children’s education. Prioritizing these goals based on their importance and urgency can help you allocate your savings effectively. It’s also helpful to make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, "Save $5,000 for a down payment on a car within 12 months" is a SMART goal. If you're saving for a home, our post on saving for your first city home could provide valuable insights.

Setting Up Automatic Transfers for Savings

Automation is key to the success of a "pay yourself first" strategy. Setting up automatic transfers from your checking account to your savings or investment accounts eliminates the temptation to spend that money on other things. Most banks allow you to set up recurring transfers on a specific date, usually coinciding with your payday. This simple step ensures that saving becomes a consistent habit, and you don't have to actively think about it every month. You can also set up automatic contributions to your retirement accounts, such as a 401(k) or IRA, directly from your paycheck.

The Benefits of Prioritizing Savings

Building a Secure Financial Future

Prioritizing savings is the foundation of a secure financial future. It allows you to build a financial safety net that can protect you from unforeseen circumstances, such as job loss or medical emergencies. Consistent saving also provides the funds needed to achieve your long-term financial goals, like retirement or buying a house. By having a solid savings plan in place, you can reduce financial stress and enjoy greater peace of mind knowing that you are prepared for the future.

Creating an Emergency Fund

An emergency fund is a critical component of any sound financial plan. It acts as a buffer against unexpected expenses, such as car repairs, medical bills, or job loss. Having an emergency fund prevents you from going into debt or disrupting your long-term savings goals when these emergencies occur. Financial experts generally recommend saving three to six months' worth of living expenses in an easily accessible account. This fund provides a sense of security and allows you to handle life's challenges without undue financial stress.

Reducing Financial Stress and Anxiety

Financial stress and anxiety are common issues that many people face. Prioritizing savings can significantly reduce these feelings by providing a sense of control over your finances. Knowing that you have a solid savings plan in place and an emergency fund to fall back on can bring a sense of calmness and confidence. This allows you to make more informed financial decisions and avoid the panic that often accompanies financial difficulties.

Achieving Long-Term Financial Goals

Saving consistently is the key to achieving long-term financial goals. Whether it's buying a home, funding your children's education, or retiring comfortably, having a disciplined savings plan is essential. The "pay yourself first" strategy ensures that you are consistently putting money aside for your future, rather than relying on whatever is left over. This proactive approach increases your chances of achieving your dreams and living the life you envision.

Common Misconceptions and Challenges

Overcoming the Fear of Not Having Enough Money

One of the biggest challenges to saving is the fear of not having enough money to cover your current expenses. This fear can prevent many people from adopting a "pay yourself first" approach. However, it's important to remember that saving doesn't have to be an all-or-nothing proposition. You can start small and gradually increase your savings contributions over time. The key is to make it a habit and be consistent. Remember, even saving a small amount is better than not saving at all.

Addressing Existing Debt Before Saving

Another common challenge is dealing with existing debt. It can be difficult to prioritize savings when you have outstanding credit card balances or student loans. While it's important to address your debt, it doesn't necessarily mean you should put your savings on hold completely. A balanced approach could involve allocating a portion of your income to debt repayment while simultaneously saving a smaller amount. Once you've paid down your high-interest debt, you can then increase your savings contributions. As NerdWallet suggests, consider categorizing debt payments as savings to help resolve this issue.

Avoiding Lifestyle Creep

Lifestyle creep is the tendency to increase your spending as your income grows. This can derail your savings goals if you're not careful. To avoid lifestyle creep, be intentional about your spending and regularly review your budget. When you get a raise, consider increasing your savings contributions rather than automatically increasing your discretionary spending. This will help you stay on track with your financial goals and build wealth over time.

Adjusting Your Plan as Needed

Your financial situation is not static; it changes over time. Therefore, your "pay yourself first" plan should be flexible enough to adapt to these changes. If you experience a job loss or a significant life event, you may need to adjust your savings contributions temporarily. The key is to regularly review your plan and make adjustments as needed. This adaptability will ensure that your savings plan remains effective and relevant to your evolving needs.

"Pay Yourself First" vs. Traditional Budgeting

How "Pay Yourself First" Differs From Traditional Budgeting Methods

Traditional budgeting methods often involve tracking every expense and categorizing your spending to see where your money is going. While this can be effective, it can also be time-consuming and tedious. "Pay yourself first," on the other hand, takes a reverse approach. Instead of focusing on your expenses, you prioritize your savings first and then allocate the remaining money to your needs and wants. This method simplifies the budgeting process and makes saving a non-negotiable part of your financial plan.

The Advantages of Reverse Budgeting

Reverse budgeting, as explained by NerdWallet, offers several advantages over traditional budgeting. It's less time-consuming, requires less tracking, and makes saving a priority. By automatically setting aside a portion of your income for savings, you eliminate the temptation to spend that money on other things. This approach helps you focus on the big picture and reduces the likelihood of impulsive purchases. Reverse budgeting is a practical and effective way to build wealth and achieve your financial goals.

The Importance of Automation for Success

Automation is a critical component of a successful "pay yourself first" strategy. Setting up automatic transfers from your checking account to your savings or investment accounts ensures that saving becomes a consistent habit, without needing constant attention. This removes the temptation to skip a contribution and spend those funds on other things. Automation simplifies the savings process and helps you stay on track with your financial goals, even when life gets busy.

Practical Tips for Saving Money

Reducing Unnecessary Expenses

Reducing unnecessary expenses is a crucial step in freeing up more money for savings. Take a close look at your spending habits and identify areas where you can cut back. This might include reducing your dining out expenses, canceling unused subscriptions, or finding cheaper alternatives for your everyday needs. Small changes can add up to significant savings over time.

Finding Ways to Increase Your Income

Increasing your income is another effective way to boost your savings. Consider exploring side hustles, freelancing opportunities, or asking for a raise at work. Even a small increase in income can make a big difference to your savings rate. The extra income can be directly funneled into your savings accounts, accelerating your progress toward your financial goals. Our post on funding your tech startup provides insights into different income streams, though focused on startups, the principles can be broadly applied.

Using Budgeting Apps and Tools

Budgeting apps and tools can make it easier to track your spending, set savings goals, and automate your savings. Many free and paid apps are available, offering features such as expense tracking, budgeting templates, and automatic transfer options. These tools can simplify the budgeting process and help you stay on top of your finances.

Seeking Professional Financial Advice

If you're unsure where to start or need help developing a personalized financial plan, consider seeking professional financial advice. A financial advisor can provide guidance on various aspects of personal finance, including budgeting, saving, investing, and debt management. They can help you develop a strategy that aligns with your unique financial goals and circumstances. Thrivent offers coaching programs to help you with your budget.

The Future of "Pay Yourself First" in 2025

Adapting to the Changing Economic Landscape

The economic landscape is constantly evolving, and it's important to adapt your "pay yourself first" strategy accordingly. Factors such as inflation, interest rates, and job market fluctuations can impact your financial situation. Regularly reviewing your budget and savings plan will help you stay prepared and adjust your strategy as needed. Staying informed about economic trends and seeking expert advice can also help you navigate these changes effectively.

How to Stay Committed to Your Savings Goals

Staying committed to your savings goals requires discipline and consistency. It's important to remind yourself of your long-term financial goals and the reasons why you are saving. Visualizing your desired future can help you stay motivated and focused. Regularly reviewing your progress and celebrating your milestones can also help you stay on track.

Resources and Tools for Continued Success

Numerous resources and tools are available to support your savings journey. These include budgeting apps, online financial calculators, educational websites, and financial coaching programs. Taking advantage of these resources can help you stay informed, make better financial decisions, and achieve your savings goals.

Conclusion: Taking Control of Your Financial Future

The "pay yourself first" strategy is a simple yet powerful approach to personal finance. By prioritizing savings and making it a non-negotiable part of your budget, you can take control of your financial future and build long-term wealth. This approach is not about depriving yourself but about making conscious choices that align with your financial goals. Remember, the small steps you take today can lead to significant financial security and peace of mind in the future. By following these principles and making a commitment to saving, you can pave the way to a brighter financial future.