Overview of Bitcoin's Price Journey

Bitcoin has come a long way since its inception in 2009. From a niche digital currency to a mainstream financial asset, its price journey has been marked by significant milestones and fluctuations. Understanding this journey provides insight into Bitcoin's potential future.

The Launch of Bitcoin: Initial Price and Market Reception

Bitcoin was launched in January 2009 by an anonymous entity named Satoshi Nakamoto. Initially valued at virtually zero, it wasn't until October 2010 that Bitcoin first reached a price of $0.08. Early adopters were mainly tech enthusiasts and libertarians who appreciated Bitcoin's decentralized nature and potential to function as an alternative currency. The first real-world transaction was famously conducted in 2010 when Laszlo Hanyecz purchased two pizzas for 10,000 bitcoins, marking a pivotal moment in Bitcoin's history.

Major Milestones in Bitcoin's Price History

Price Fluctuations from 2009 to 2015

Bitcoin's price remained relatively stable until 2011, when it experienced its first significant surge, reaching $29.60. However, this was followed by a sharp decline, closing the year at around $5. The fluctuations continued, with notable milestones in 2013 when Bitcoin's price crossed $1,000 for the first time, only to fall back to around $500 by the end of the year.

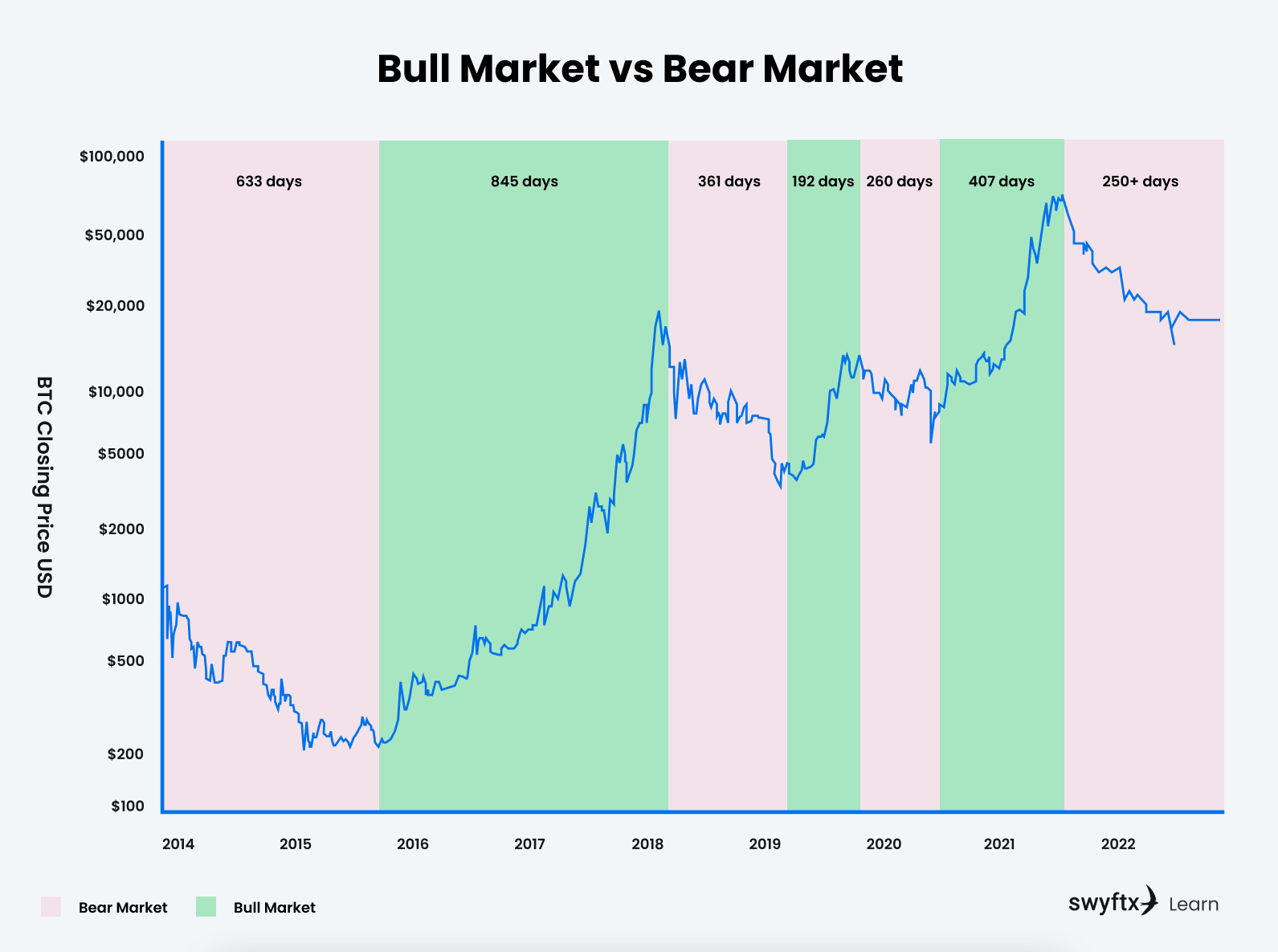

Significant Growth Periods (2016-2020)

The years 2016 to 2020 saw Bitcoin's price steadily increase, particularly during the 2017 bull run when it skyrocketed to nearly $20,000 by December. The 2020 pandemic fueled another surge, with Bitcoin closing the year at about $28,993, driven by increased institutional interest and the perception of Bitcoin as "digital gold."

Recent Trends Leading to 2025

As of December 2024, Bitcoin reached an all-time high of $106,000, propelled by renewed enthusiasm in the market and favorable regulatory changes under the incoming Trump administration. Analysts are now predicting a potential price of $180,000 by 2025, driven by increased institutional investment and a favorable macroeconomic environment.

Source: LiteFinance

Factors Influencing Bitcoin's Price Growth

Understanding the factors influencing Bitcoin's price can help investors make informed decisions.

Demand and Supply Dynamics

Bitcoin's supply is capped at 21 million coins, creating scarcity. As demand increases, particularly from institutional investors and retail buyers, the price tends to rise. The halving events, which occur approximately every four years, reduce the reward for mining new bitcoins, thereby limiting supply and potentially driving prices up.

The Impact of Bitcoin Halving Events

The most recent Bitcoin halving occurred in April 2024, reducing the block reward from 6.25 to 3.125 bitcoins. Historically, these halving events have led to significant price increases. For instance, after the 2020 halving, Bitcoin's price rose dramatically in the following months.

Regulatory Changes and Their Effects on Price

Regulatory developments play a crucial role in influencing Bitcoin's price. The approval of Bitcoin exchange-traded funds (ETFs) in January 2024 has opened new avenues for institutional investment, contributing to the recent price surges. The anticipated regulatory environment under Trump's administration is expected to be more favorable, further boosting investor sentiment.

Market Sentiment and Media Influence

Market sentiment, driven by news and social media, can lead to rapid price fluctuations. Positive coverage tends to attract more investors, while negative news can trigger sell-offs. The Fear & Greed Index, which measures market sentiment, often correlates with Bitcoin's price movements.

Bitcoin Price Predictions for 2025

Looking forward, analysts have made various predictions regarding Bitcoin's price trajectory in 2025.

Analyst Forecasts and Expert Opinions

Predictions from Financial Institutions

VanEck predicts Bitcoin could reach $180,000 by 2025, citing increased legitimacy and demand as key drivers. Tom Lee from Fundstrat Global Advisors suggests a more conservative estimate of $250,000, emphasizing the importance of upcoming halving events and institutional adoption.

Comparison of Historical Predictions vs. Current Trends

Historical predictions have often underestimated Bitcoin's volatility and rapid price movements. The current bullish sentiment, combined with macroeconomic factors, suggests that predictions for 2025 may not be as far-fetched as they once appeared.

The Role of Institutional Investment in Bitcoin's Future

Institutional investment is pivotal for Bitcoin's future growth. Major asset managers are increasingly adding Bitcoin to their portfolios, legitimizing it as a viable investment asset. This trend, combined with regulatory support and growing public interest, paints a positive outlook for Bitcoin heading into 2025.

Source: 99Bitcoins

Investment Trends and Strategies

As Bitcoin continues to gain traction, understanding investment trends is crucial for prospective investors.

Current Trends in Bitcoin Investment

The market is witnessing a paradigm shift, with a growing distinction between retail and institutional investors. Retail investors are more inclined to invest in Bitcoin as a long-term holding, while institutions are focusing on Bitcoin as a strategic asset class.

Retail vs. Institutional Investor Behavior

Retail investors often react to market sentiment, leading to volatile price swings. In contrast, institutional investors typically approach Bitcoin with a long-term strategy, seeking to benefit from its potential as a hedge against inflation.

Risks and Considerations for Future Investors

Investing in Bitcoin is not without risks. Market volatility, regulatory changes, and technological advancements can significantly impact prices. Investors should conduct thorough research and consider their risk tolerance before entering the market.

Long-Term Outlook: Is Bitcoin a Good Investment?

While Bitcoin's price has shown remarkable growth, potential investors should weigh the risks against the potential for high returns. Many experts argue that Bitcoin's scarcity and growing acceptance as a store of value make it a compelling long-term investment.

Conclusion: The Future of Bitcoin Towards 2025

Recap of Key Insights and Predictions

Bitcoin's price journey has been characterized by dramatic fluctuations and significant growth. The factors influencing its price, such as demand and supply dynamics, regulatory developments, and market sentiment, will continue to shape its future.

The Importance of Staying Informed on Bitcoin's Market Dynamics

As we approach 2025, staying informed on market trends, regulatory changes, and investment strategies is essential for navigating the evolving landscape of Bitcoin and cryptocurrency.

Key Takeaways:

- Bitcoin has experienced significant price growth since its launch, reaching an all-time high of over $106,000 in December 2024.

- Factors like demand, supply dynamics, regulatory changes, and market sentiment play crucial roles in Bitcoin's price movements.

- Analysts predict Bitcoin could reach between $180,000 and $250,000 by 2025, driven by institutional investment and favorable regulations.

- Investors should remain cautious of market volatility and conduct thorough research before investing in Bitcoin.

- Understanding the evolving landscape of cryptocurrency is vital for making informed investment decisions.