Understanding Bitcoin Halving: A Clear and Simple Breakdown

What is Bitcoin Halving?

Definition and Process of Bitcoin Halving

Bitcoin halving is a pre-programmed event that occurs approximately every four years on the Bitcoin network. This event reduces the block reward miners receive for validating transactions by half. Initially, the reward was set at 50 bitcoins per block in 2009, which has undergone several reductions over the years. With each halving, the reward diminishes, making new bitcoins scarcer. For instance, during the last halving on April 19, 2024, the block reward was reduced from 6.25 BTC to 3.125 BTC.

Importance of Bitcoin Halving in the Crypto Ecosystem

Halving events are crucial because they control the supply of Bitcoin, which is capped at 21 million coins. This scarcity is a fundamental aspect that gives Bitcoin its value. By limiting the number of new bitcoins introduced into circulation, halvings help to mitigate inflation and enhance the asset's appeal as a store of value, similar to precious metals like gold.

History of Bitcoin Halving

Timeline of Past Halving Events

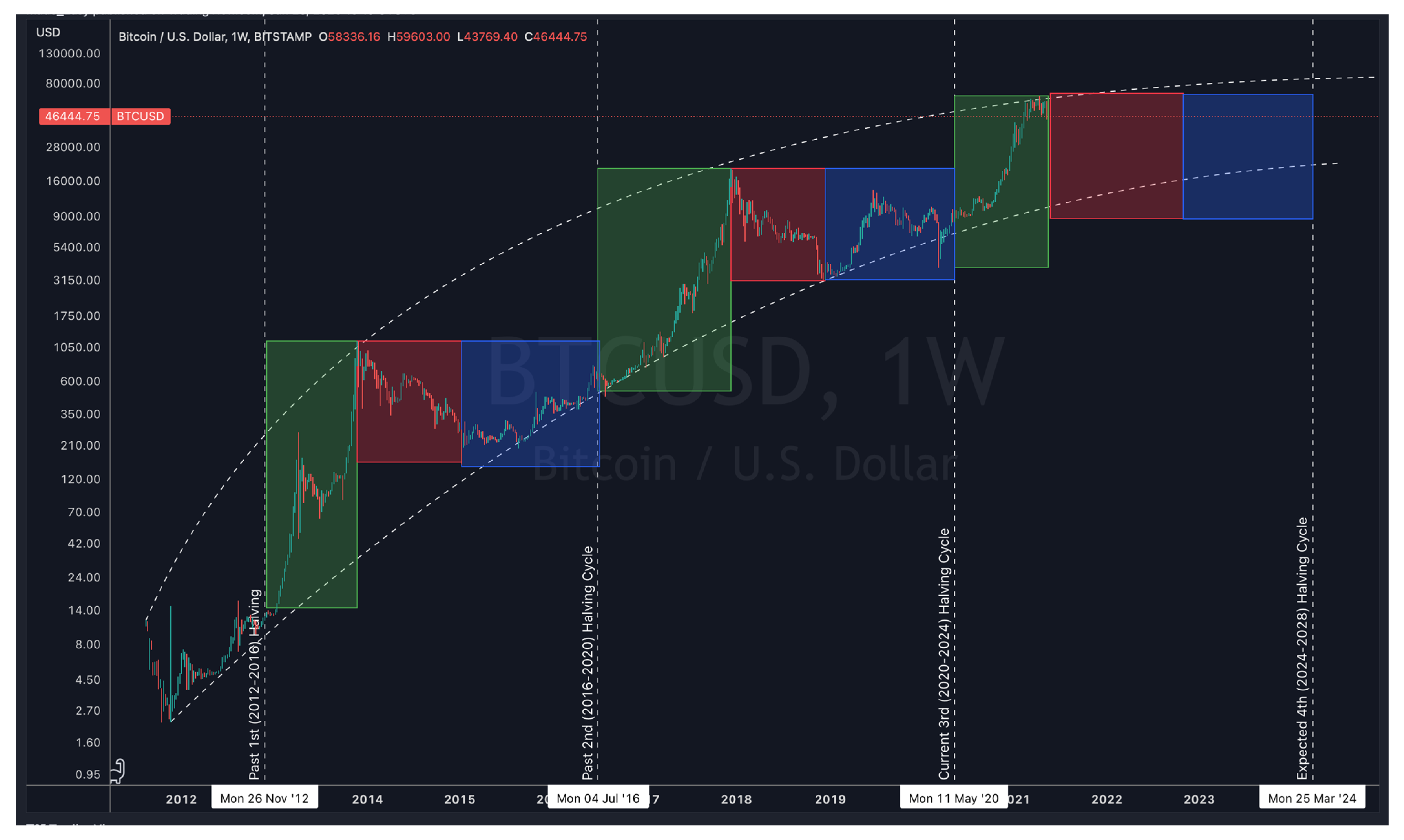

- First Halving (2012): On November 28, 2012, the reward dropped from 50 BTC to 25 BTC.

- Second Halving (2016): On July 9, 2016, the reward was halved again, from 25 BTC to 12.5 BTC.

- Third Halving (2020): The most recent halving occurred on May 11, 2020, reducing the reward from 12.5 BTC to 6.25 BTC.

- Fourth Halving (2024): The latest halving took place on April 19, 2024, decreasing the block reward to 3.125 BTC.

Historical Price Trends Post-Halving

- Price Movements Before and After Each Halving: Historically, Bitcoin's price tends to experience significant increases after each halving. For instance, after the first halving in 2012, Bitcoin's price soared from about $12 to over $1,000 within a year. Following the 2020 halving, Bitcoin reached an all-time high of nearly $69,000 in 2021.

- Long-term Value Implications: These price surges often lead investors to view Bitcoin as a long-term investment, further driving demand and price appreciation.

The Next Bitcoin Halving Event

When is the Next Bitcoin Halving?

The next Bitcoin halving is anticipated to occur on March 26, 2028, when the block reward will decrease to 1.5625 BTC. As the halving approaches, miners and investors alike will closely monitor market trends and sentiment.

Implications for Miners and Investors

- Changes in Mining Rewards: With the reduction in block rewards, mining profitability could be affected. Miners will need to efficiently manage their costs and operations to remain profitable in light of lower rewards.

- Market Sentiment and Speculation Surrounding the Event: Prior to halvings, market speculation often increases, leading to price volatility. Investors may rush to purchase Bitcoin in anticipation of price rises, leading to pre-halving rallies.

Impact of Bitcoin Halving on Price Dynamics

Scarcity and Demand

The halving significantly impacts Bitcoin's supply dynamics. By reducing the number of new bitcoins entering the market, it creates a scarcity effect that can lead to increased demand. Historical data suggests a strong correlation between halving events and subsequent price increases.

Market Sentiment and Speculation

Leading up to a halving, investor sentiment can drive speculative behavior. Many traders expect prices to rise post-halving, resulting in increased buying activity before the event. However, it's essential to understand that while historical trends indicate price increases, market conditions may differ each cycle.

Understanding the Mechanics of Bitcoin Halving

How Bitcoin Mining Works

Bitcoin operates on a proof-of-work system where miners validate transactions and secure the network. They compete to solve complex mathematical puzzles, and the first to solve it adds a new block to the blockchain, earning the block reward. This process is vital for maintaining the integrity and security of the Bitcoin network.

Economic Theories Behind Halving

The halving aligns with traditional economic principles of supply and demand. As the rate of new bitcoin creation decreases, the limited supply can drive value appreciation, especially if demand remains constant or increases. This principle is akin to how commodities like gold are valued.

Common Misconceptions About Bitcoin Halving

Myths vs. Reality

- Immediate Price Increases Post-Halving: Many believe that Bitcoin's price will surge immediately after a halving. While historical trends show price increases, these are not guaranteed and can take months to materialize.

- The Effect on Mining Profitability: Some think that halvings will make mining unprofitable. However, miners often adjust their strategies, and technological advancements can help maintain profitability.

- Long-term Value Guarantees: Despite the deflationary nature of Bitcoin, its long-term value is influenced by various factors, including market sentiment and regulatory developments.

Conclusion

The Significance of Bitcoin Halving for Future Investments

Bitcoin halving plays a pivotal role in shaping the cryptocurrency's supply dynamics. Understanding these events is crucial for investors, as they can significantly influence market trends and price movements.

Anticipating Market Changes and Trends

As Bitcoin continues to evolve, staying informed about halving events will help investors navigate the cryptocurrency landscape. The anticipation surrounding halvings often leads to increased market activity, making these events crucial for understanding Bitcoin’s potential trajectory.

Key Takeaways

- Bitcoin halving reduces block rewards by 50%, impacting supply.

- Historical halvings have led to significant price increases post-event.

- The next halving is expected on March 26, 2028, reducing rewards to 1.5625 BTC.

- Market sentiment surrounding halvings can drive speculative behavior.

- Understanding the mechanics and implications of halving is essential for investors.

For those looking to deepen their understanding, check out related articles like After Bitcoin's $106K Record: Are We Heading for a Market Correction? and What Can Bitcoin Miners Expect to Earn per Coin in 2025?.